Our Approach

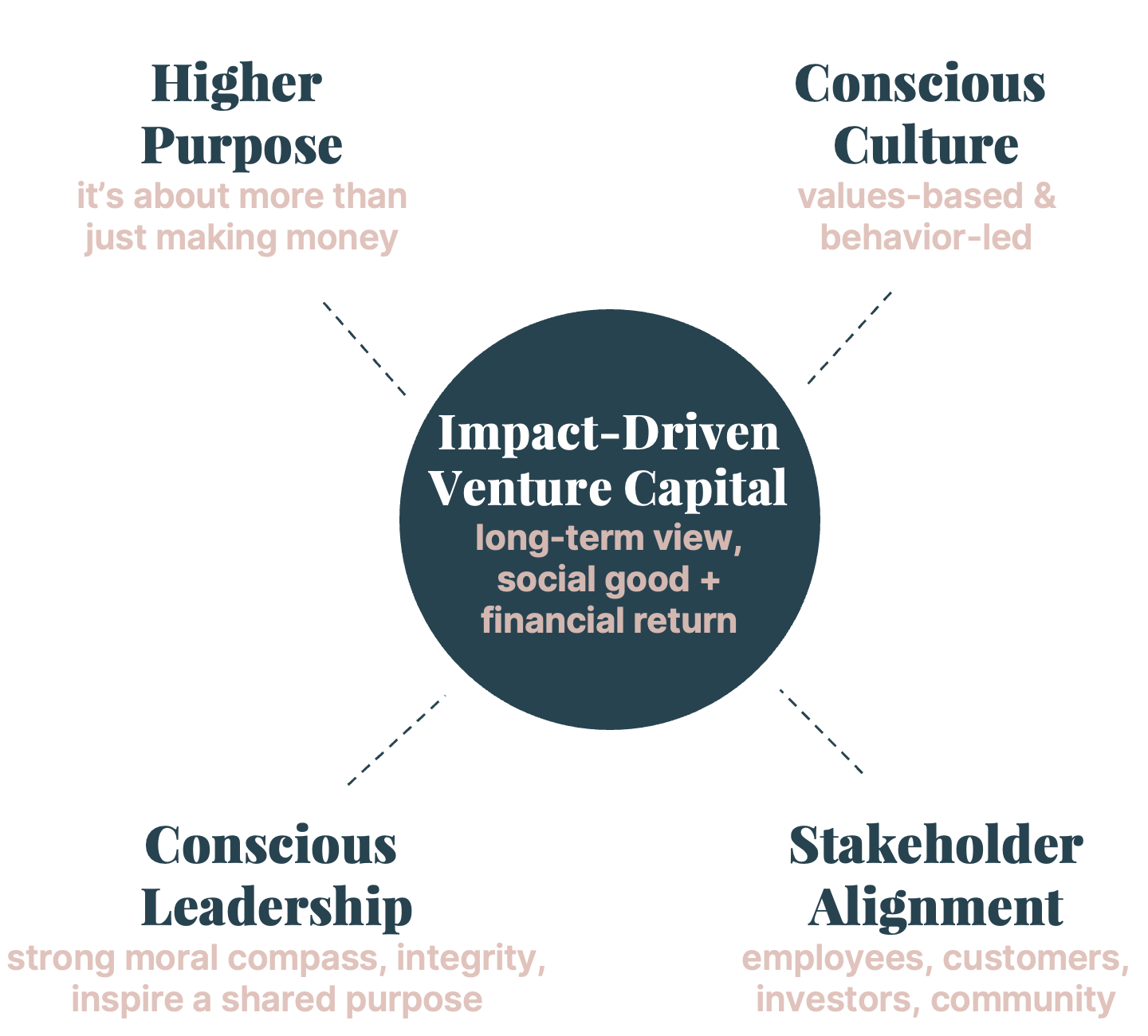

Focuses not simply on maximizing profits but managing the balance between social impact and financial returns.

PATIENT CAPITAL + CONSCIOUS CAPITALISM

Early-stage companies tend to have founders that are subject matter experts or have technology expertise, but commonly lack knowledge and experience in operations, people management, go-to-market, and scaling a business.

Many venture capital firms and investors claim to take a hands-on approach – they promise their time, to leverage their network, and to roll up their sleeves with founders and their teams. The reality is that very few actually follow through and do it. Samaritan’s investment criteria will include identifying opportunities where Samaritan can impact the trajectory of the company through more than just financial resources.

At Samaritan, our goal is to ensure portfolio companies don’t try to reinvent the wheel and waste time and money by making mistakes through trial and error – which in many cases can be crippling to an early-stage business. Between our decades of experience actually running companies, and our community of seasoned senior operators, we help our founders and CEOs get smart quick, avoid blind spots, and fill in gaps in their knowledge and resources. If needed, we can play interim or fractional roles or identify advisors from our community that can assist in problem-solving and accelerate the business. We are happy to roll up our sleeves because it’s what we love to do – develop teams and build businesses.

WE ARE TRUE PARTNERS

The Samaritan team takes a hands-on approach to helping portfolio companies reach their full potential.